Services

Case Studies

Peter & Julie aged 48 and 53 respectively.

They have a home valued at $432,000 In Highland Park with a home loan of $256,000 paying $1374 per month @ 5% with an anticipated term of 30 years.

Peter earns a salary of $72,500 and Julie $48,500. Their living expenses are $45,000 per annum.

They wanted to save on their tax and invest for the future.

$600 per week (modelling done to ensure they always had a tenant)

Take a look at some more stats –

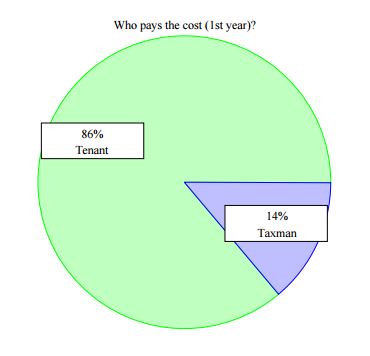

Their was no input required to hold the investment property as at settlement it was a cash positive position.

The investment property was new and would save Julie $3,176 per annum and Peter $3,088 per annum (combined total of $6,624) They decided the purchase the property 50 / 50

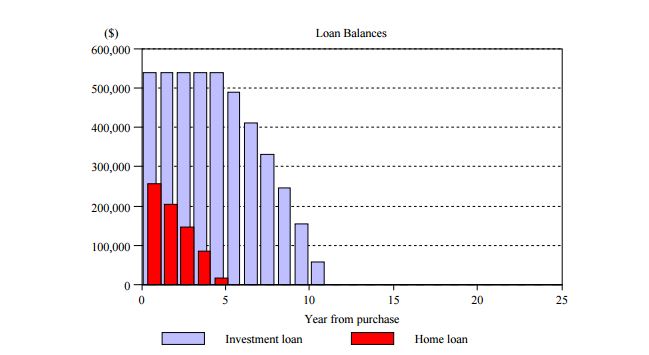

As a result of the purchase they were able to use cash flow from the property and this enabled them to repay their home loan in 5 years and the investment property in 11 years.

Case Study – Jane & Darren

They have a home valued at $450,000 In New Lambton with a home loan of $210,000 paying $1118 per month @ 5% with an anticipated term of 30 years.

Darren earns a salary of $65,000 and Jane $35,000. Their living expenses are $45,000 per annum.

They wanted to save on their tax and invest for the future.

They purchased an investment property (borrowing the entire amount using equity in their home) for $417,600 and estimated they would always have a tenant if they charged weekly rental of $365 per week (modelling done to ensure they always had a tenant)

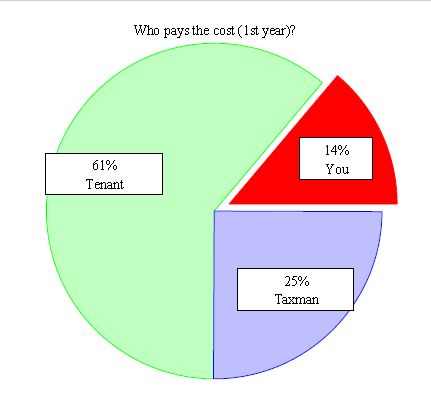

The input required to hold the investment property was $83 per week.

Take a look at some more stats –

The investment property was new and would save Jane $460 per annum and Darren $7104 per annum (combined total of $7564.00) They decided the purchase the property 50 / 50 as jane was planning to return to full time work in the future.

As a result of the purchase they were able to use cash flow from the property and this enabled them to repay their home loan in 6.8 years and the investment property in 15.8 years.